Our Services

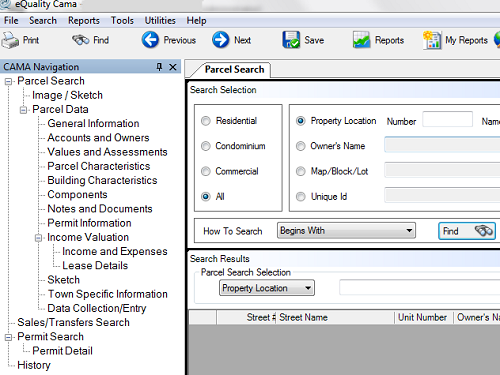

CAMA Software

Our CAMA software is a powerful and flexible, comprehensive property inventory and valuation solution for the Assessor community. eQuality provides the functionality to maintain, value and track properties and associated revenue. It is built on the Microsoft Platform, using the most up-to-date .net and web technologies.

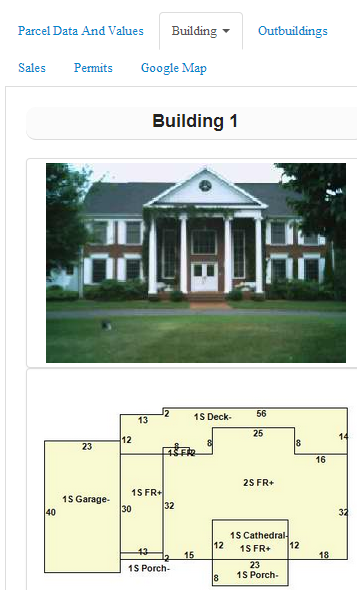

Online Property Cards

Our Online Property Field Card website can be tailored for each Municipality. It provides the ability to choose not only the data you want to display but the label and sequence of each field. Using the Towns Banner and text from the Assessor, it can be seamlessly linked to from the Towns web page. Using a standardize data format, we have the ability to interface with any other CAMA Software Vendor.

Revaluation Services

Our company assures that fair and equitable assessment of properties is achieved by calibrating the valuation models. Our Appraisers have in-depth knowledge of Mass Appraisal as well as single property appraisal skills. Our services can be tailored to the specific needs of each Municipality. From Full to Hybrid to Updates; we have the management skills and tools to successfully deliver your Revaluation Project.

Services and Solutions

Using our Software

eQuality CAMA provides the tools and functions of what is needed during a Revaluation as well as the features needed to support the Assessor’s office with its day to day needs to manage, analyze and maintain real property information.

Valuation Model

eQuality software provides the ability to tailor the valuation model for the specific needs of the Municipality. Working with the Valuation supervisor, the Assessor can customize the data to be gathered and the cost tables to meet their specific needs.

Appraisal Experience

Our Company assures that the fair and equitable assessment of properties is achieved our staff members which have the highest level of mass appraisal skills. Not only do we have in-depth knowledge of the Mass Appraisal industry but also have single property appraisal skills.

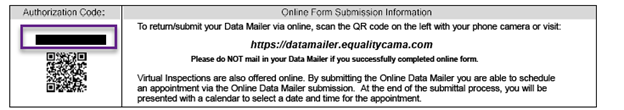

Tablet

eQuality CAMA has the ability to export parcels to a Tablet. This function allows the Assessor to export parcels from eQuality CAMA, take the Tablet to the field to make modifications, import the data back into eQuality CAMA.

Customer Support

Customer Service is not what we do, it is who we are. eQuality support staff is there for you via telephone, email and remote access. Our affordable support contracts provide you with all of the support you will need from assistance in sketching to help in reporting.

Staffing Solutions

Look to eQuality to assist you with additional staffing for Permit Work, Data Entry, Single Parcel Appraisals or even Collection for a Revaluation.

Our Team

About Us

Who we are?

eQuality Valuation Services understands that with the never-ending budget pressures at all levels of government, property taxes are an increasing fiscal lifeline for municipalities. Because of the importance of this vital revenue resource, it is imperative that municipalities completely, accurately and fairly apply the property tax burden to their taxpayers based on fair and equitable assessment. Our software application is user friendly and we provide a unique “hands on” approach to customer service and support.

What we do?

Our company assures that the fair and equitable assessment of properties is achieved by our staff members which have the highest level of mass appraisal skills as well as single property appraisal skills for defending assessments. eQuality will work with the Municipality to identify areas which may require additional focus such as Condominium Associations, specific design types on Residential buildings, and land topography. We have extensive experience in the commercial sector including special use properties.

Why choose us?

Unlike other revaluation companies, at eQuality the Assessor and their staff have full access to the revaluation database – Real Time. This provides the Assessor with the ability to monitor the progress of the project from start to end. They can review the data collection, data entry and the valuation at any time throughout the project.